Tuesday, February 25th | 2:00 PM ET

Linking Tactical & Strategic Initiatives

Across Your CRE Portfolio to Maximize

Cashflow & Returns

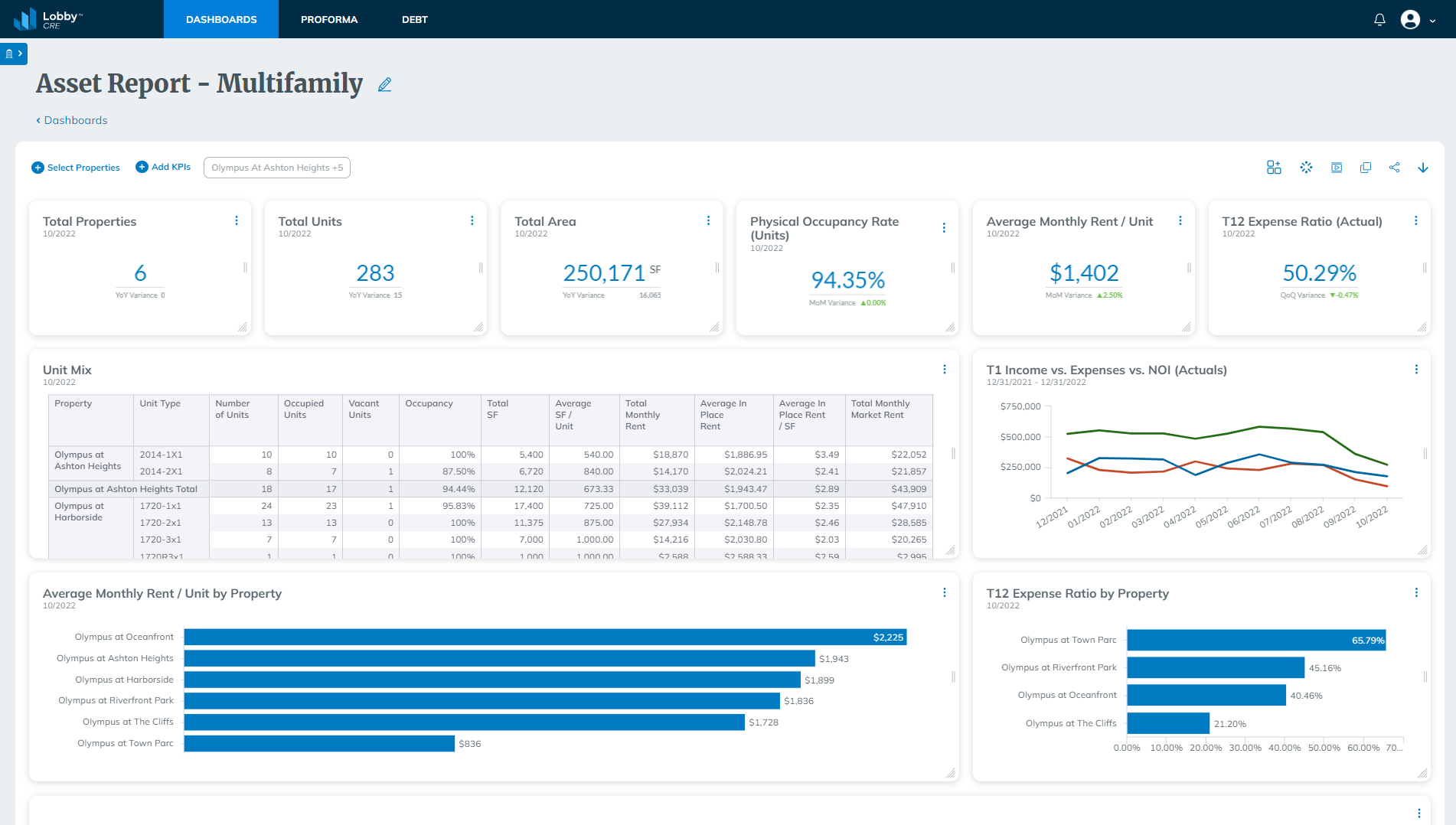

Successful CRE firms have one thing in common: visibility into past, present, and future operations. The challenge, however, is effectively harnessing and leveraging your portfolio’s data, so you can make proactive strategic decisions.

As an all-in-one operating platform that provides visibility at the property- and portfolio-level, you have the tools to strengthen operations, run “what if” simulations, and understand the impacts of each scenario on your NOI, valuations, debt, equity, and more. The result is visibility that will help maximize cashflow and returns.

Email marketing@thirtycapital.com for questions about attending this product tour.

Join us and learn how you can:

✓ Centralize and streamline data and reporting for faster insights and the ability to monitor asset and portfolio performance daily.

✓ Leverage Business Intelligence (BI) tools to visualize, analyze, and report on performance data.

✓ Run asset scenarios using your own financials and make assumptions in operations and capital expenses.

✓ Make proactive strategic decisions by understanding how asset scenarios impact valuations, debt, and equity.

✓ Assess your cashflow strategy and determine next best steps and optimal timing for operational improvement.

_______________________________________________________________________________________

Trusted by Top CRE Firms

Protect, manage, and optimize cashflow for faster returns.

Copyright © 2025 Defease With Ease | Thirty Capital. All Rights Reserved.